- Rustic Flute

- Posts

- 🏡Weaver’s $170 Million Win

🏡Weaver’s $170 Million Win

AI-Powered Growth Meets Underserved India

Hey there!

It’s Sparsh here!👋

India’s housing dreams just got a new champion. Weaver Services, a Bengaluru-based fintech startup, has raised a massive $170 million (~₹1,482 crore) in a funding round led by Lightspeed, Premji Invest, and Gaja Capital. 💵

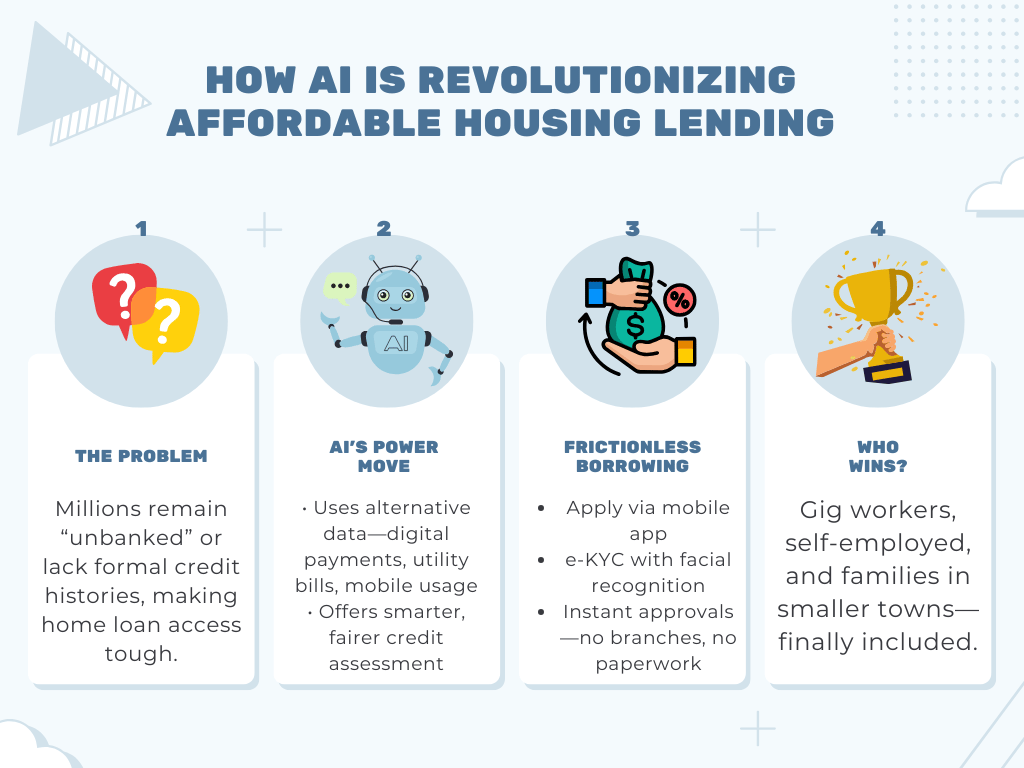

With AI at the core of its affordable housing finance platform, Weaver is on a mission to make home loans faster, fairer, and more accessible, especially for those often left out by traditional lenders. 💰

This investment signals a bold leap forward for both the startup and India’s real estate future. 🏠

📰 What just went down

💸Funding Surge: Weaver Services has signed agreements to raise $170 million, about ₹1,481.5–1,482 crore, led by Lightspeed and Premji Invest, with participation from Gaja Capital. The round is among the largest recent investments in the affordable housing finance space in India.

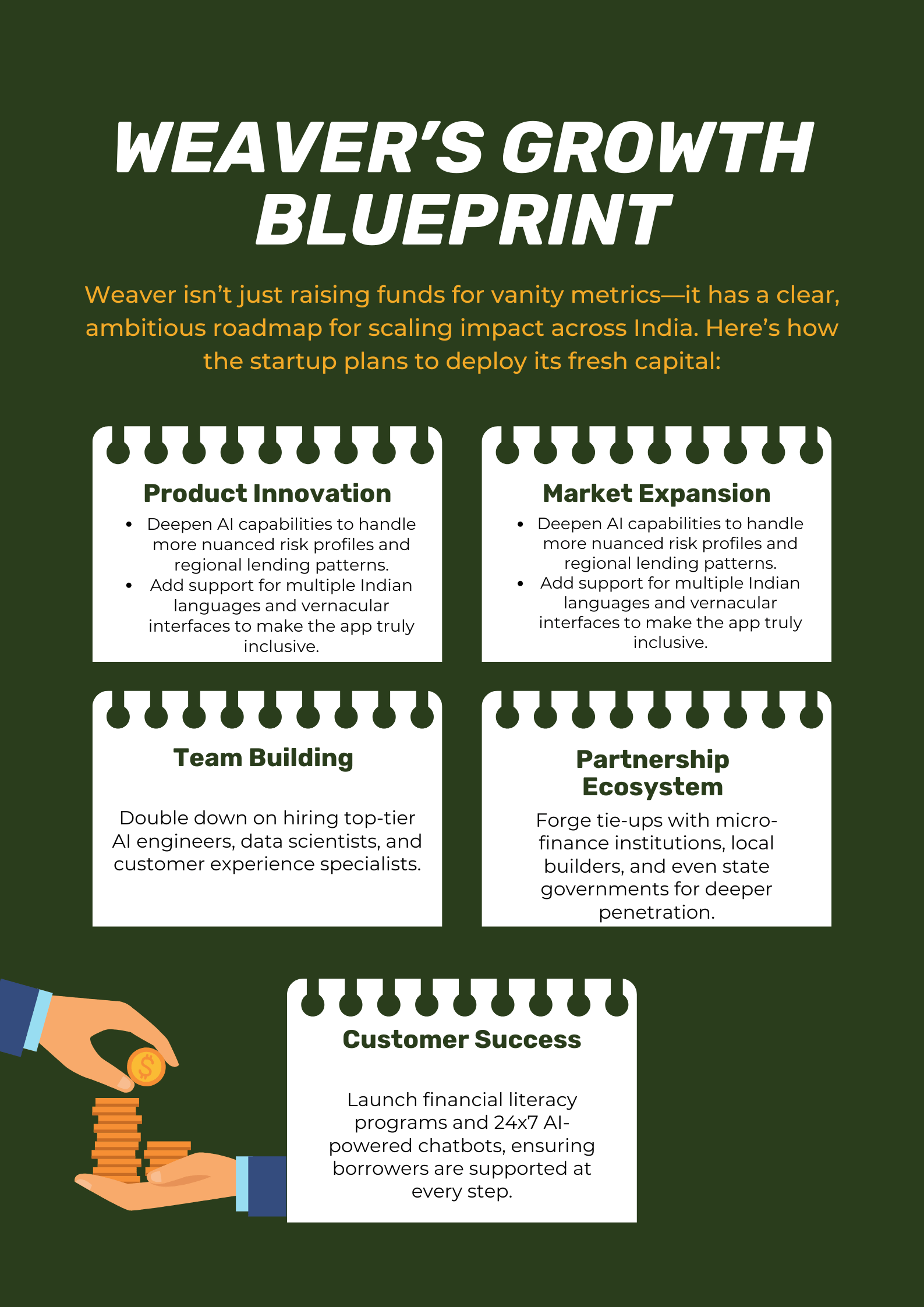

🎯Strategic Fuel: The proceeds are earmarked for asset acquisitions, technology innovation, and expansion into tier-2 and tier-3 cities.

👥Core Customers: Weaver aims to serve self-employed individuals often excluded by traditional banks, making home ownership more achievable to millions.

🤝 The Power Investors Behind Weave

When Lightspeed, Premji Invest, and Gaja Capital come together, the ecosystem takes notice. Each of these firms is known for identifying and nurturing market disruptors. ⚡️

Their collective backing is more than just a capital infusion; it’s a strong endorsement of Weaver’s vision and tech-first approach. 💪

Lightspeed has championed global unicorns and is renowned for its early support of tech trailblazers. 🦄

Premji Invest brings deep sectoral expertise and a reputation for scaling high-impact businesses. 📊

Gaja Capital is no stranger to growth-stage bets in India’s financial services and technology arenas. 🏆️

Together, these investors are betting that affordable housing finance, powered by AI, could be one of the largest growth stories in India’s next decade. 🚀

🌏 Why Affordable Housing is India’s Next Big Opportunity

India’s urban population is surging—around 600 million people are projected to live in cities by 2036. Despite this, millions still struggle to own homes. 🧱

The urban affordable housing shortage is estimated at 20–31 million units, and mainstream lenders frequently avoid first-time buyers with informal incomes leaving a vast segment underserved.💼

Here’s why this matters to investors and founders:

1️⃣ 🐖Financial Inclusion:

🔹Bringing millions into the formal credit fold unlocks new markets and revenue streams.

2️⃣ 🎓Societal Impact:

🔹Home ownership is linked to better education, improved health, and stronger communities.

3️⃣ 📑Government Support:

🔹Schemes like Pradhan Mantri Awas Yojana (PMAY) create tailwinds for new models in housing finance.

4️⃣ 💻Tech Adoption:

🔹Digital penetration in tier-2 and tier-3 cities is at an all-time high, making tech-led solutions like Weaver’s more viable than ever.

🤝From Skip to Engage: A Better Approach

🧩Reframe PoCs into Value Pilots

Define the scope clearly

Set expectations (paid, outcome-based, time-boxed)

Treat PoCs as two-way investments, not one-sided freebies

📈Pilot small, scale smart

Offer base versions domestically to gather testimonials

Use those wins to prove product-market fit and expand globally

🛒Educate enterprise buyers

Walk clients through startup realities—limited budgets, need for partnership

Teach them PoC models that align startup and enterprise incentives

🧠 Use innovation sandboxes

Leverage government or enterprise labs to co-develop use cases

Break barriers to access and build credibility gradually

🔮 Trends and Implications for Investors and Founders

The ripple effects of Weaver’s funding round are already being felt across the ecosystem. For investors, this is a front-row seat to one of the most exciting intersections of AI and real-world impact in India. ✍🏻

For founders, Weaver’s journey offers some key takeaways:

⤷🧩Solve Real Problems: Don’t just chase trends—focus on sectors with deep, persistent pain points.

⤷💻Leverage Tech for Scale: AI and automation can unlock markets previously considered unviable.

⤷🇮🇳Build for Bharat: Regional inclusion and vernacular support are non-negotiable for massive scale in India.

⤷💡Partner Smart: Collaboration with local players and government schemes can speed up adoption and reduce friction.

⤷🥇Even the best tech means little without robust customer support and education

👋 Final Thoughts

Weaver’s $170 million raise is more than just another funding headline; it’s a signal that affordable housing finance in India is set for a technological leap. 📈

By blending smart AI with a deep understanding of local realities, Weaver is not only solving a massive problem but setting the blueprint for the next generation of Indian fintech. 🤖

For investors and founders tuned in to India’s housing story, this is a moment to watch and, maybe, participate in. The dream of a home for every Indian family is becoming a little more real and a lot more digital. 🏠️

Which aspect of India’s affordable housing challenge grabs your attention? |

That’s me when I see you refer! You can forward this email and ask them to click the link 🙏🙏. | I pour my heart into crafting this email every week for free. It would mean the world to me if you could share Rustic Flute with just one person you think would love it, too. Here's your unique referral code: |

It has been a pleasure! I will see you next week. Until then, Stay motivated! Stay strong! Cheers!

Reply