- Rustic Flute

- Posts

- ⚡October Startup and Investment Pulse

⚡October Startup and Investment Pulse

Key moments, mega deals, and fresh moves for founders and investors 🚀

Hey there!

It’s Sparsh here!👋

October’s startup scene was packed with surprises, stretching from record-breaking funding rounds to new regulations and standout IPOs🏢.

Whether you’re building the next unicorn or just tracking the trends, these headlines reveal what’s working—and what’s shifting. Get all the biggest moments and sector swings of the past month here! 🗓️

Let’s dive in to know more! 🚀

📊 October’s Funding Frenzy

October was a wild ride for startup fundraising. Zepto sparked headlines with a $450 million round, easily topping the month’s charts. Big names like Uniphore, Snapmint, and Dhan captured 9-digit sums of their own, making October the second-highest month for funding in 2025 at $1.73 billion total. 💵

Venture capitalists went big on growth-stage firms, showing that solid traction still unlocks meaningful capital even in choppy markets. 📈

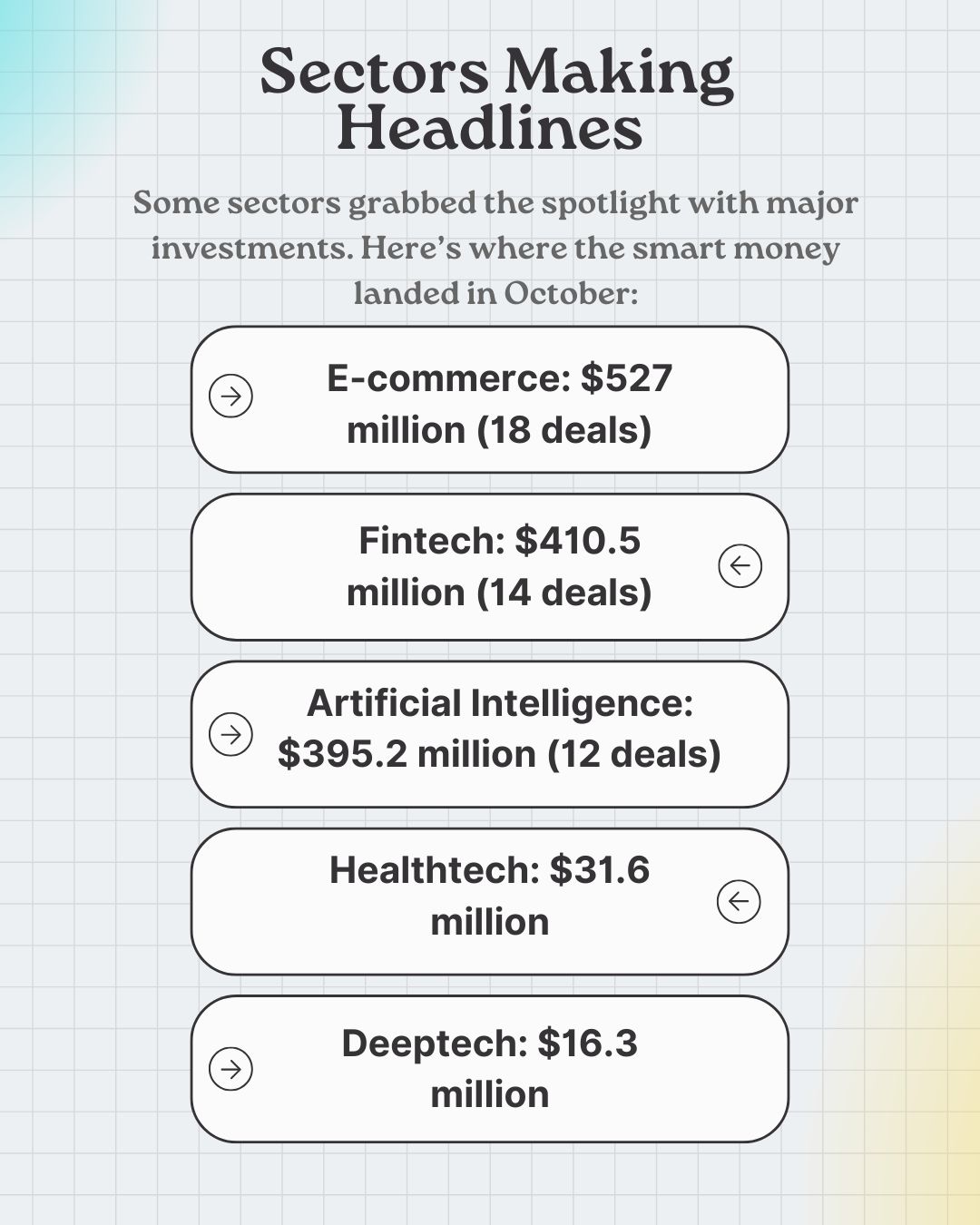

E-commerce led the way, with investors pouring $527 million across 18 deals. Fintech continued its streak, notching $410 million in total, while AI came just behind with $395 million—proof that next-gen tech remains a hot bet for everyone looking for outsized returns. 🤑

💼 Sectors Making Headlines

While funding was strong for consumer tech and fintech, healthtech and deeptech cooled off, signalling a short-term tactical shift for venture strategists. 📈

🦾 Noteworthy IPO Buzz

Public listings became serious talking points. Companies like Lenskart and Groww geared up for future IPOs, while boAt, Curefoods, and Milky Mist inched closer to their debuts. 🥛

Private equity-backed IPOs hit record levels, with $369 million raised across 16 exits in Q3 alone—setting new benchmarks for the local ecosystem. 🌐

Urban Company snatched Startup of the Year honours at the ET Startup Awards, proof that operational excellence gets noticed. 🏅

🕵️ Regulatory Moves to Watch

SEBI’s new Angel Fund Framework shook up the investing landscape, setting stricter boundaries on who can back future startups. Only accredited investors are now allowed for angel-based funds, with new rules in force until September 2026. 📆

This means more discipline, better oversight, and less risk for fledgling ventures—a win for seasoned investors and those looking to protect their capital. 🛡️

Founders should be aware: the new requirements demand five accredited backers before first close, urging platforms to step up their compliance game. ⚖️

👥 Angel Investing Highlights

Angel investing stayed lively, with networks collectively deploying over $7 million into cutting-edge tech and sustainable businesses during October. 💸

Launchpad Venture Group announced a remarkable 13x exit—proving that patience is still a winning strategy if you back the right innovations. 👼

👔 Layoff Trends and Startup Shifts

Layoffs slowed noticeably, bringing relief after several rocky months. Zepto and Simpl trimmed a combined 380 roles, but shutdowns were minimal, with Hike and Mypickup announcing closures. 🚫

Swiggy cut losses and doubled down on cost discipline—a sign that many founders are finally prioritizing operational efficiency over unchecked growth. 📉

🌍 Global Context

Venture capital saw robust global activity with $120 billion deployed through 7,579 deals in Q3. While the Americas dominated the biggest rounds, Asia saw major moments in logistics, aerospace, and real estate. 🏡

AI investments fueled billion-dollar bets, and Europe captured attention with a string of high-value tech deals. The investment map is more competitive than ever, and sector winners are often the ones moving fastest and thinking deepest. 🌐

Each one brings something fresh to the table, reminding founders and investors just how lively—and crowded—today’s playing field can be. 🚦

✨ What Founders and Investors Should Note

So, what’s the October takeaway for anyone building or backing startups?

Fundraising is competitive, but traction and clarity matter most. 💰

Think operational discipline—cost and compliance are top of mind.⚙️

E-commerce and fintech are charging ahead, but don’t neglect regulatory surprises.📦

Angel networks and strategic exits are showing real returns for patient capital.🚪

Watch for shifts in global capital and sector swings as you chart your next move.🌍

October’s roundup proves the ecosystem is anything but predictable; it’s fast, ambitious, and loaded with new opportunities for those who read between the lines. 🔥

How do you prefer to keep up with startup news? |

That’s me when I see you refer! You can forward this email and ask them to click the link 🙏🙏. | I pour my heart into crafting this email every week for free. It would mean the world to me if you could share Rustic Flute with just one person you think would love it, too. Here's your unique referral code: |

It has been a pleasure! I will see you next week. Until then, Stay motivated! Stay strong! Cheers!

Reply